All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money value of an IUL are typically tax-free up to the amount of costs paid. Any type of withdrawals over this amount might be subject to tax obligations depending on policy framework.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the individual is over 59. Possessions withdrawn from a conventional or Roth 401(k) prior to age 59 may incur a 10% charge. Not exactly The cases that IULs can be your very own financial institution are an oversimplification and can be misguiding for many factors.

You may be subject to updating associated health and wellness inquiries that can influence your ongoing costs. With a 401(k), the cash is always yours, including vested employer matching no matter of whether you give up adding. Danger and Assurances: Most importantly, IUL plans, and the money worth, are not FDIC insured like basic checking account.

While there is usually a flooring to stop losses, the development capacity is topped (indicating you may not completely gain from market growths). The majority of experts will agree that these are not comparable products. If you want survivor benefit for your survivor and are worried your retirement financial savings will not suffice, then you may wish to take into consideration an IUL or various other life insurance product.

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

Sure, the IUL can offer accessibility to a cash account, yet once again this is not the key function of the product. Whether you desire or need an IUL is an extremely individual inquiry and depends upon your main economic goal and objectives. However, below we will certainly attempt to cover advantages and limitations for an IUL and a 401(k), so you can additionally mark these products and make an extra educated choice concerning the most effective method to take care of retired life and caring for your enjoyed ones after death.

Equity Indexed Universal Life Insurance Contracts

Financing Expenses: Loans versus the plan accumulate interest and, if not paid back, reduce the death advantage that is paid to the recipient. Market Participation Limits: For the majority of plans, investment development is connected to a stock exchange index, yet gains are normally topped, restricting upside potential - università telematica iul. Sales Practices: These plans are usually marketed by insurance representatives who might highlight advantages without fully discussing expenses and risks

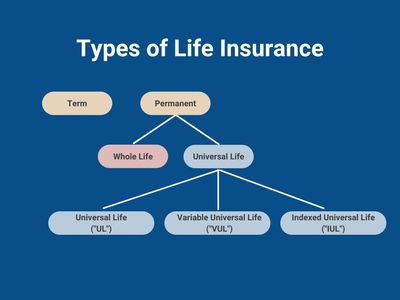

While some social media experts recommend an IUL is an alternative item for a 401(k), it is not. Indexed Universal Life (IUL) is a type of long-term life insurance coverage plan that also offers a cash value component.

Latest Posts

Full Disclosure Indexed Universal Life Report

What Is An Index Universal Life Insurance Policy

What Is An Iul Investment